Roku’s stock is falling after strong earnings. This is the reason.

The well-known streaming service Roku (NASDAQ: ROKU) shocked investors with better-than-expected second-quarter earnings, reporting robust revenue growth and shrinking losses. But rather than rejoicing, Wall Street reacted with a precipitous sell-off, which caused Roku’s stock to plummet. Many are curious about the underlying causes of this paradox—strong performance yet declining stock.

The Earnings Beat Was Insufficient

Roku’s Q2 performance appeared excellent on paper. Revenue reached $912 million, a 17% year-over-year increase and significantly higher than analysts had predicted. Active accounts increased to 83.5 million, indicating a strong growth signal, and the company recorded a smaller net loss than it did during the same period previous year. But during after-hours trading, the price fell more than 10%.

The future was the problem, not the past.

The Costs and Disappointments of Guidance Are High

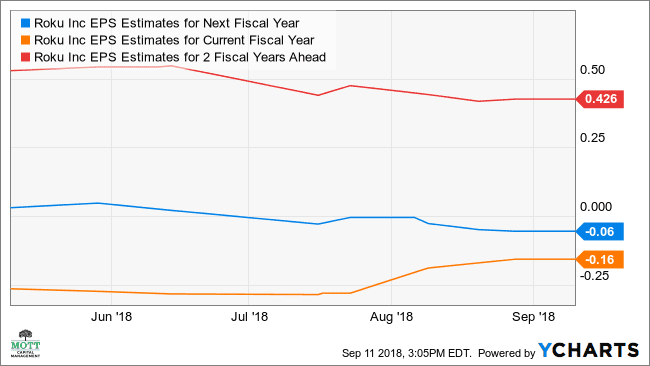

Roku provided cautious projections for the upcoming quarter, suggesting that growth may decelerate, despite the impressive quarter. The business mentioned macroeconomic factors that would affect future profits, namely big brands’ cautious ad spending and rising content expenses.

Roku’s growing operating costs are another issue that worries investors. The platform’s bottom line is suffering as a result of its growth and expenditures in new services like AI-powered content suggestions and smart home integrations. The company’s profit margins are still under strain, particularly as the rivalry from industry titans like Amazon and Google heats up.

Outlook streaming is becoming more congested and costly due to competition and caution. A robust digital advertising ecosystem is essential to Roku’s ad-supported business strategy. But because to economic uncertainties, marketers have been more frugal with their spending, which has a direct effect on Roku’s main source of income.

Investors are also doubting Roku’s ability to hold onto its position in an industry that is becoming more and more fragmented. As streaming sticks and smart TVs become more and more commonplace, Roku must stand out from the competition by innovating its platform as well as its content.

A Perfection-Priced Stock?

Roku’s stock had already had a notable increase in 2025 prior to its report, propelled by optimism surrounding digital advertising and AI-powered video platforms. As a result, the stock was perfectly valued. Investors tend to jump ship as soon as even a slight cloud, such as margin issues or moderate forecast, arises on the horizon.

To put it briefly, Roku produced impressive results, but not enough to support its high value or allay long-term worries about sustainable growth, growing expenses, and intense competition.

Conclusion:

Expectations against reality is exemplified by Roku’s stock decline following its report. Even while the business is still a strong force in streaming, there are several obstacles in its way. Investors expect a clear path to long-term profitability and competitive resilience, not just strong earnings. Even after impressive performance, Roku’s stock can still see volatility until it offers such certainty.

Post Comment