The foreign exchange market, commonly known as the Forex market, is the largest and most liquid financial market in the world. Among its various forms, the spot Forex market stands out as the most straightforward and immediate form of currency trading. This article provides a detailed look at what the spot Forex market is, how it operates, and its significance in the global financial landscape.

What is the Spot Forex Market?

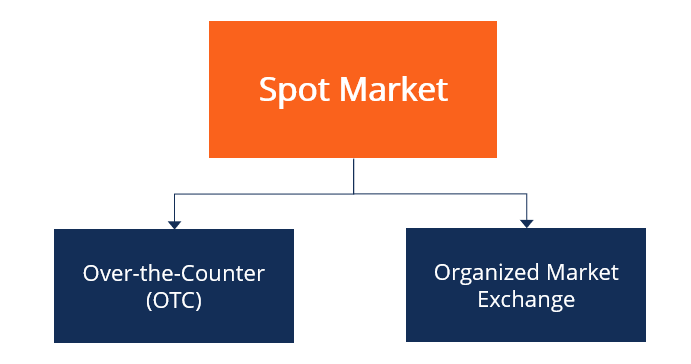

The spot Forex market involves the direct exchange of one currency for another at the current market price, known as the spot rate. Transactions in this market are typically settled within two business days, unlike futures or options contracts which have specified settlement dates in the future. The immediacy of these transactions is what defines the “spot” nature of the market.

Key Characteristics of the Spot Forex Market

1. Liquidity: The spot Forex market is the most liquid financial market, with an average daily trading volume exceeding $6 trillion. This immense liquidity ensures that traders can enter and exit positions with minimal price slippage.

2. 24-Hour Market: Operating 24 hours a day, five days a week, the spot Forex market allows for continuous trading across different time zones. Major financial centers, including London, New York, Tokyo, and Sydney, ensure that the market is always active.

3. Currency Pairs: Trades in the spot Forex market are conducted in currency pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is the base currency, while the second is the quote currency.

How the Spot Forex Market Works

Trading in the spot Forex market involves buying one currency and simultaneously selling another. The price at which these currencies are exchanged is determined by supply and demand dynamics in the market. Here’s a simple breakdown of how a typical transaction occurs:

1. Quotation: When a trader wants to exchange currencies, they receive a quote consisting of a bid price (the price at which the market will buy the base currency) and an ask price (the price at which the market will sell the base currency).

2. Execution: The trader places an order based on the quoted prices. Orders can be executed almost instantaneously due to the high liquidity of the market.

Major Players in the Spot Forex Market

1. Commercial Banks: These institutions conduct large volumes of currency transactions for themselves and their clients.

2. Central Banks: National central banks intervene in the Forex market to stabilize or increase the value of their national currency.

3. Investment Managers and Hedge Funds: These entities engage in Forex trading to diversify their portfolios and hedge against currency risks.

4. Corporations: Multinational companies participate in the Forex market to manage the risks associated with currency fluctuations and to pay for goods and services in foreign currencies.

5. Retail Traders: Individual traders also participate in the spot Forex market, often using online trading platforms to speculate on currency movements.

Benefits and Risks

Benefits: – Accessibility: With the advent of online trading platforms, anyone with a computer and internet connection can participate in the Forex market. – Potential for Profit: The high liquidity and leverage available in the spot Forex market can offer significant profit opportunities.

Risks: – High Volatility: Currency prices can be highly volatile, influenced by geopolitical events, economic data releases, and market sentiment. – Leverage Risks: While leverage can magnify profits, it can also lead to substantial losses, potentially exceeding the initial investment.

Conclusion

The spot Forex market is a dynamic and integral part of the global financial system. Its high liquidity, continuous operation, and potential for significant returns make it an attractive arena for various market participants. However, the associated risks necessitate a thorough understanding and careful management. For anyone considering entering the spot Forex market, comprehensive education and prudent risk management strategies are essential to navigate this complex yet rewarding market successfully.